pay indiana state estimated taxes online

Cookies are required to use this site. In 2017 this rate fell to 323 and remains there through the 2021 tax year.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Find information for certified software companies looking to provide online tax filing for Indiana.

. Make an income tax payment to an already established estimated account for a corporation or nonprofit organization. To make an individual estimated tax payment electronically without logging in to INTIME. Estimated payments may also be made online through Indianas INTIME website.

Your browser appears to have cookies disabled. 2020 Individual Income Tax Forms. Visit our website at wwwingovdor4340 and follow the prompts for making an estimated tax payment.

Tax return then you should pay estimated tax. Use the worksheet below to determine how much youll owe. Use the worksheet below to determine how much youll owe.

However many counties charge an additional income tax. Tax return then you should pay estimated tax. Wheres My Income Tax Refund.

You may also pay using the electronic eCheck payment methodThis service uses a paperless check and may be used to pay the taxdue with your Indiana individual income tax. The first installment payment is due April 18 2022. DOR Tax Forms Online access to download and print DOR tax.

Property TaxRent Rebate Status. The remaining three payments. You do not need to.

To pay by credit card you may make an estimated tax payment online. Personal Income Tax Payment. Interest monthly at the rate of 18 per year on the tax balance due.

Pay your income tax bill quickly and easily using INTIME DORs e-services portal. The first installment payment is due April 18 2022. A delinquent tax collection fee of 65 of the amount due or 35 whichever is greater.

The remaining three payments. Make a timely fifth quarter payment by the original due date. Individuals and businesses can make estimated tax payments electronically through MassTaxConnect.

An official website of the Indiana State Government. A 20 payment plan fee if you enter. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form ES.

The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding. Make estimated tax payments online with MassTaxConnect. Make an estimated income tax payment through our website You can pay directly from your preferred account or by credit card through your Online Services account.

Select the Make a Payment link under the. Indiana has a flat statewide income tax. Access INTIME at intimedoringov.

Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal.

2019 State Income Tax Rates Credit Karma

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Indiana State Tax Information Support

Dor Owe State Taxes Here Are Your Payment Options

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Dor Owe State Taxes Here Are Your Payment Options

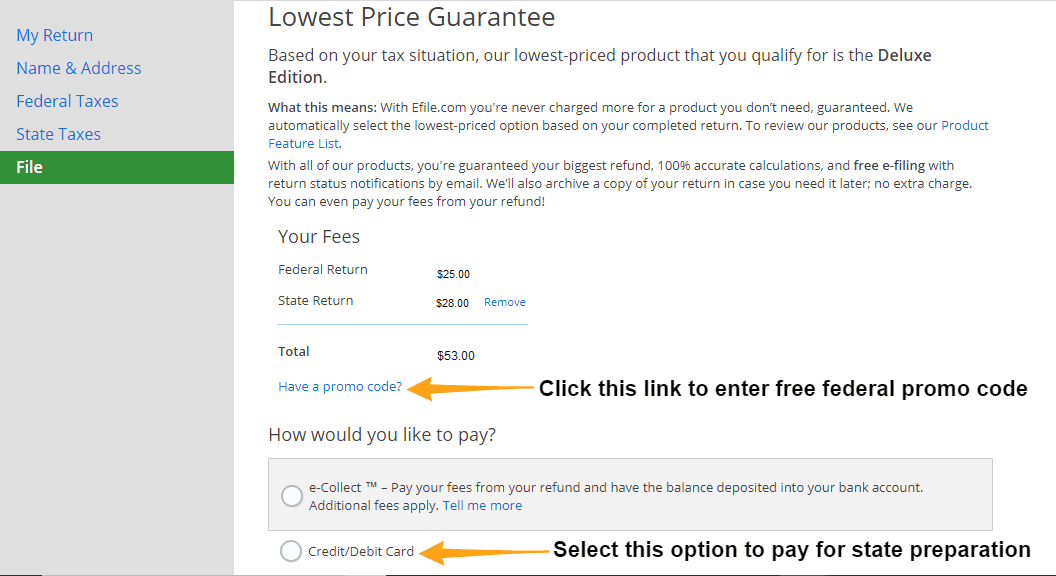

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Deluxe Online Tax Filing E File Tax Prep H R Block

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Where S My State Refund Track Your Refund In Every State

Is Indiana Tax Friendly Where Hoosier State Ranks Nationally

Dor Keep An Eye Out For Estimated Tax Payments

W 2 Form For Wages And Salaries For A Tax Year By Jan 31