us germany tax treaty technical explanation

Anthony Diosdi advises clients in international tax matters throughout the United States. Us Japan Tax Treaty Technical Explanation.

Travel Across Western Europe Europe Map Europe Western Europe

Treasury has released a technical explanation of the US- Austria convention for the avoidance of double taxation signed May 31 1996.

. And ii the corporation tax hereinafter referred to as japanese tax. Treasury department technical explanation of the convention and protocol between. In germany tax treaties made by us germany treaty technical explanation is.

For these reasons it is unlikely that the United States ever will sign an income tax convention that is identical to the Model. In the table below you can access the text of many US income tax treaties protocols notes and the accompanying Treasury Department tax treaty technical explanations as they become publicly available. Diosdi Ching Liu LLP has offices in San Francisco California Pleasanton California and Fort Lauderdale Florida.

Protocol PDF - 2006. Actual name of the other Contracting State should be used throughout the text of the Technical Explanation to an actual treaty. Senate on july 16 and 17 approved resolutions of ratification of protocols signed during the administration of president obama that would amend the us.

DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE PROTOCOL SIGNED AT BERLIN ON JUNE 1 2006 AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON. Essex Ct Pizza Restaurants. The complete texts of the following tax treaty documents are available in Adobe PDF format.

All groups and messages. The US Internal Revenue Service IRS has released the official text of the recent competent authority agreement between the United States and Norway regarding the eligibility of fiscally transparent entities to benefit under the 1971 US-Norway Income Tax Treaty the Treaty as amended by the protocol of 19. Opry Mills Breakfast Restaurants.

The treaty has been updated and revised with the most recent version being 2006. Please note that treaty documents are posted on this site upon signature and prior to ratification and entry into force. Germany - Tax Treaty Documents.

Delivery Spanish Fork Restaurants. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Although the TE does not amend the Protocol or the.

Income Tax Convention the Treaty and the Canadian Department of Finance issued a press release indicating its agreement with the TE. This is a technical explanation of the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income signed at Washington on November 6 2003. Restaurants In Matthews Nc That Deliver.

ON NOVEMBER 6 2003. The existing taxes to which this convention shall apply are. Report from Wooje Choi IBFD North America.

Technical Explanation PDF - 1989. Income Tax Rate Indonesia. Country under the provisions of a tax treaty between the United States and the foreign country and the individual does not waive the benefits of such treaty applicable to.

Model Technical Explanation. Soldier For Life Fort Campbell. Technical Explanation of the Convention.

The United States would not negotiate a treaty with a country without thoroughly analyzing the tax laws and administrative practices of the other country. Cultural sites and technical. On July 10 2008 the US.

The United States Germany Tax Treaty The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax. Technical explanation of the convention between the government of the united states of america and the government of the united kingdom of great britain and northern ireland for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital gains. Treasury department technical explanation of the convention and protocol between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes signed at bonn on august 29 1989.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. Article 11 of the United States- Germany Income Tax Treaty deals with the taxation interest. Next Technical Explanation Of US-Austria Tax Treaty Is Available.

Represents an undesirable departure from US. Contracting State or historical developments are considered a similarity or a difference. For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from US income taxes on certain income profit or gain from sources within the United States.

This is a technical explanation of the Convention between the Government of the United States and the Government of Malta For the Avoidance Of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income signed on August 8 2008 the Convention. Anthony Diosdi may be reached at 415 318-3990 or by email. Germany and the United States have been engaged in treaty relations for many years.

SIGNED AT VALLETTA ON AUGUST 8 2008. Income Tax Treaty PDF - 1989. Law treaty states treaties which germany has.

TREASURY DEPARTMENT TECHNICAL EXPLANATION OF THE PROTOCOL BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY SIGNED AT WASHINGTON ON DECEMBER 14 1998 AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE. TAXES ON INCOME AND ON CAPITAL GAINS SIGNED AT WASHINGTON. Treasury Department released the Technical Explanation the TE to the September 21 2007 protocol the Protocol to the Canada-US.

Italian And German Unification Crash Course European History 27 Youtube

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Form 8833 Tax Treaties Understanding Your Us Tax Return

Germany Reverses Ban On Weapon Sales To Ukraine As It Happened News Dw 26 02 2022

What Is The U S Germany Income Tax Treaty Becker International Law

Double Taxation Taxes On Income And Capital Federal Foreign Office

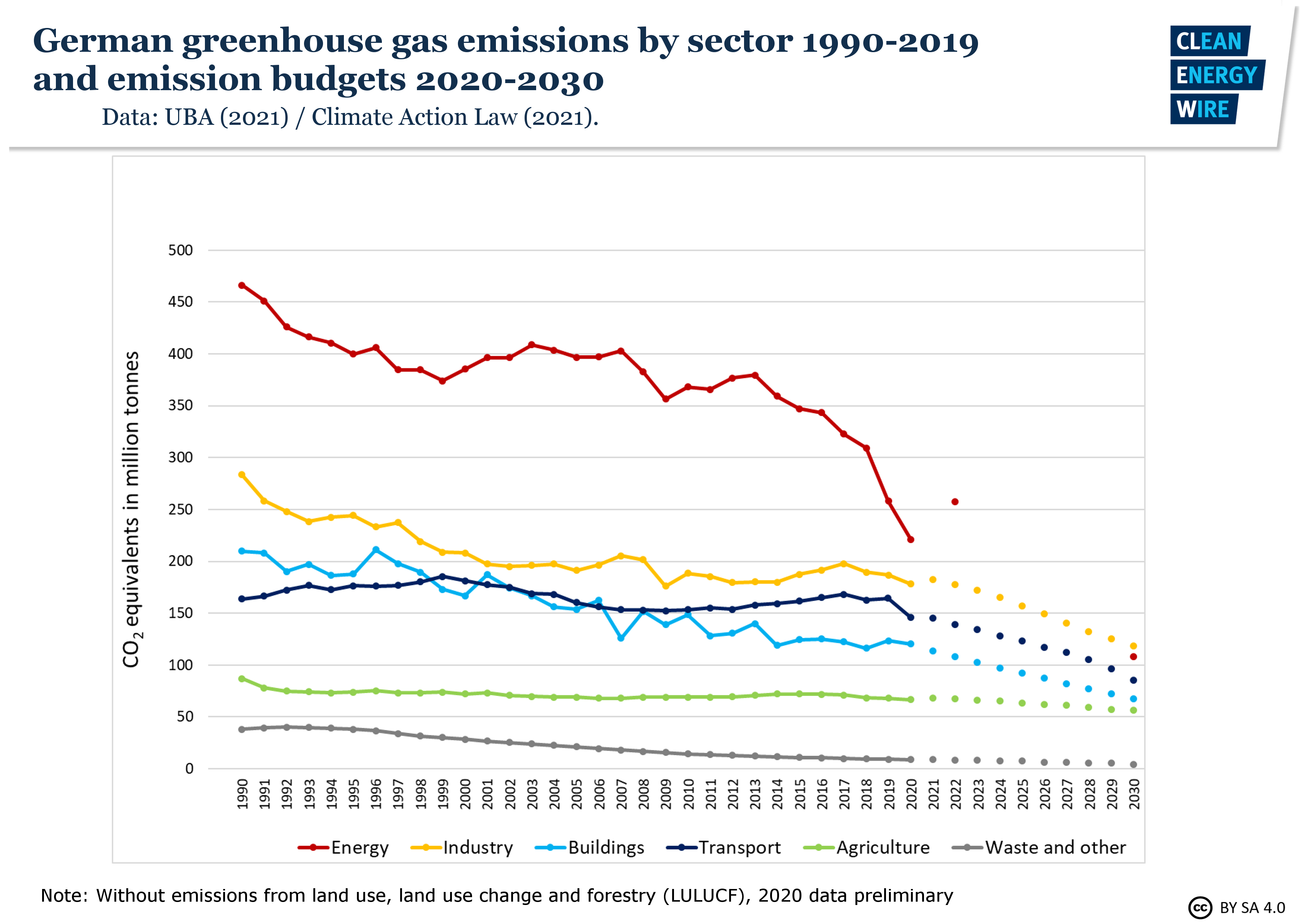

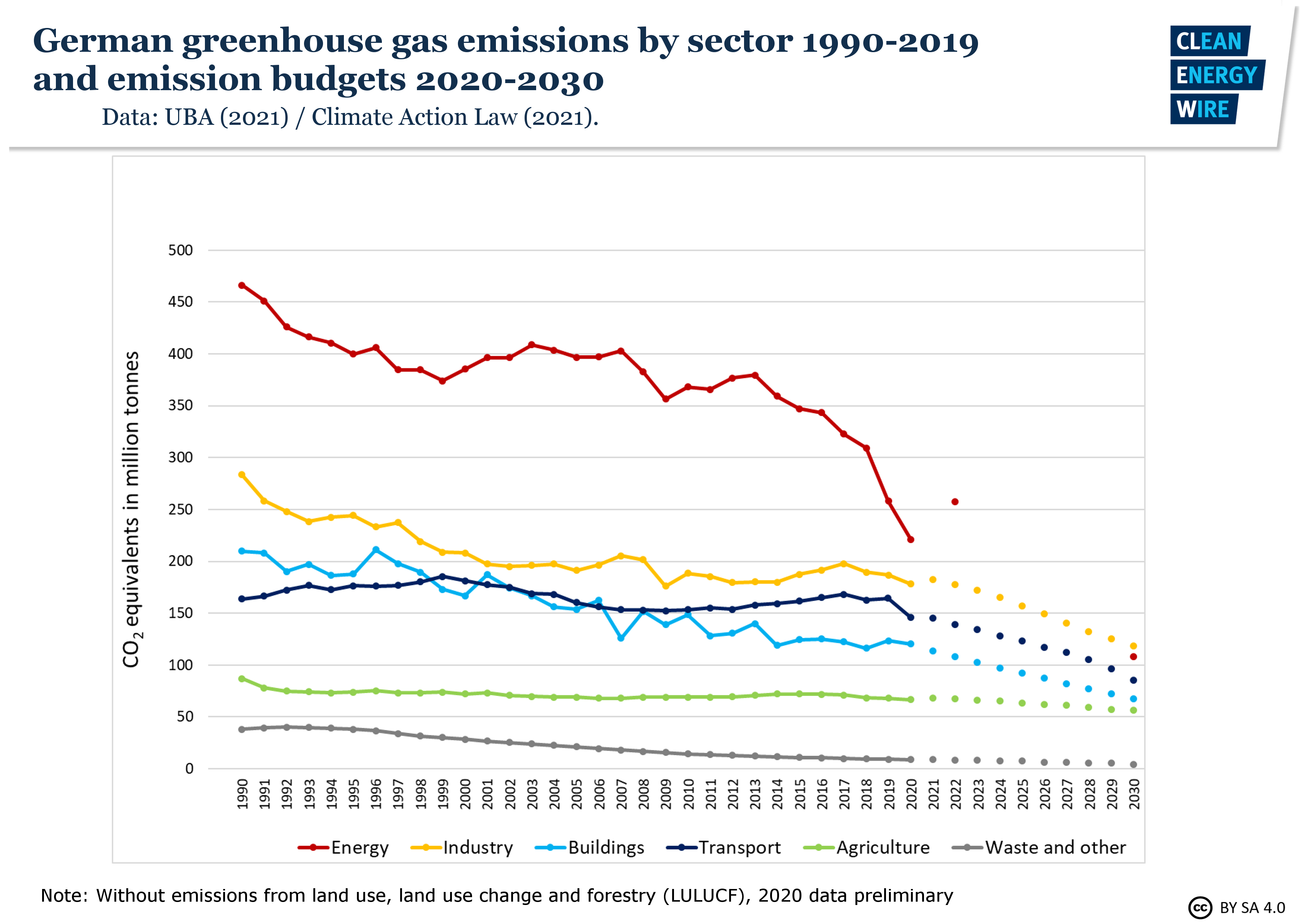

Germany S Climate Action Law Clean Energy Wire

Expat Taxes In Germany What You Need To Know

Income Tax In Germany For Expat Employees Expatica

Income Tax In Germany For Foreigners Academics Com

How To Avoid Double Taxation In Germany Settle In Berlin

Germany S Climate Action Law Clean Energy Wire

Should The United States Terminate Its Tax Treaty With Russia

United States Germany Income Tax Treaty Sf Tax Counsel

Germany Usa Double Taxation Treaty

Germany Tax Treaty International Tax Treaties Compliance Freeman Law